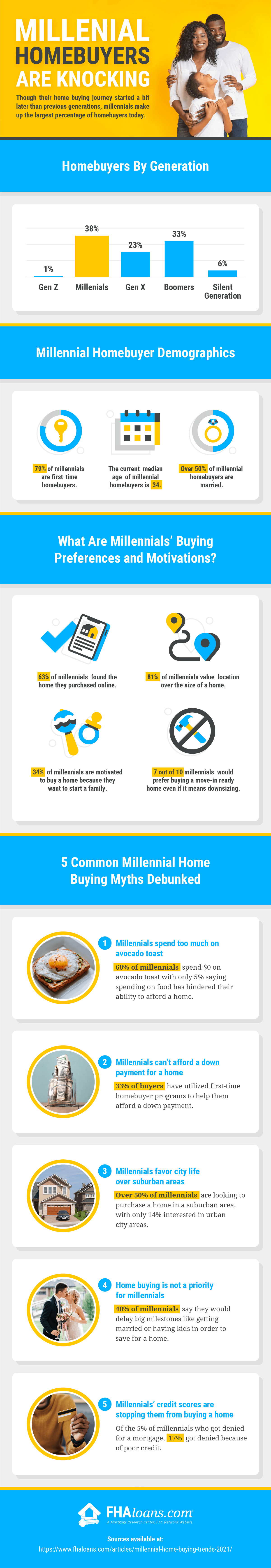

As one of the largest generations making up the housing market, millennials are looking for homes and represent the largest percentage of homebuyers today. Even though many face burdens like student loan debts, they don’t let that stand in the way of their home buying journey. Though most millennials decided to wait to enter the home buying scene compared to their baby boomer parents, they’re more ready than ever to settle down into a place of their own.

We’ve compiled a list of this generation’s preferences, challenges and all there is to know about what this generation is looking for as they take the housing market by storm. Read on to get a glimpse into how this generation treats the home buying journey — or jump straight to the infographic below.

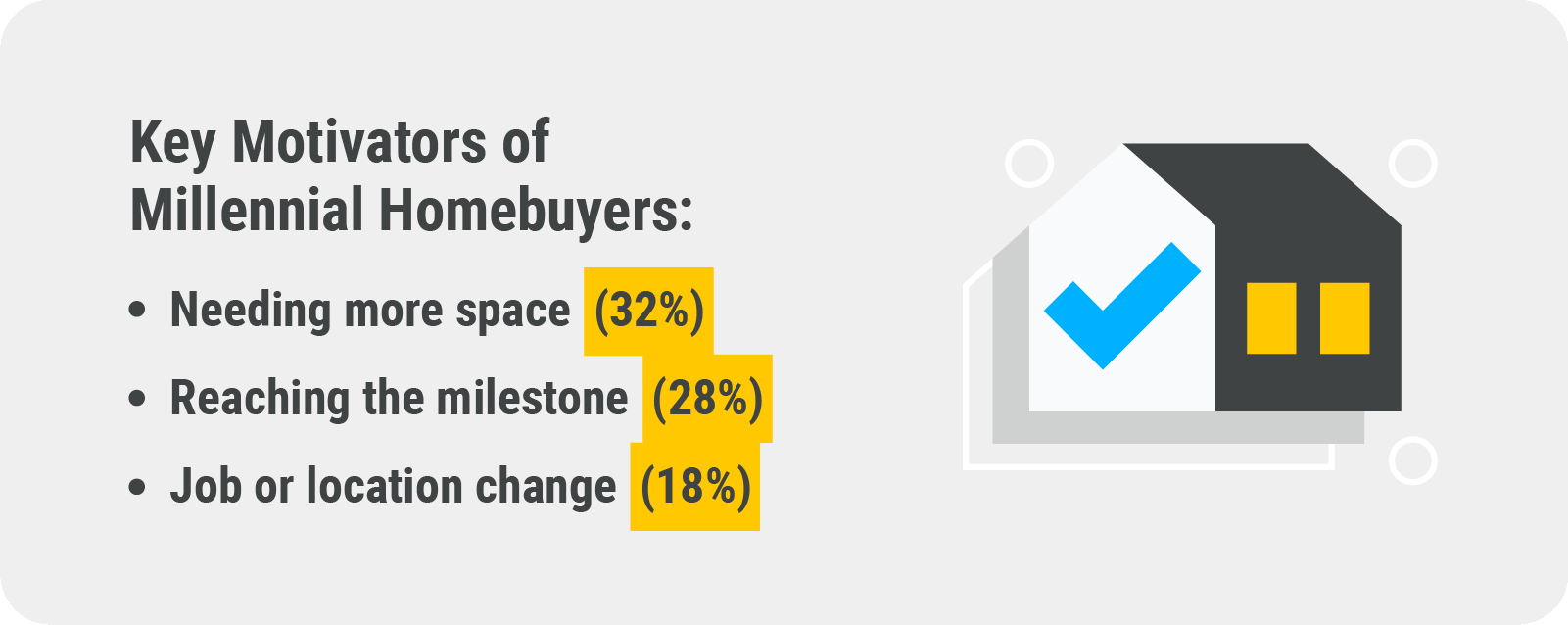

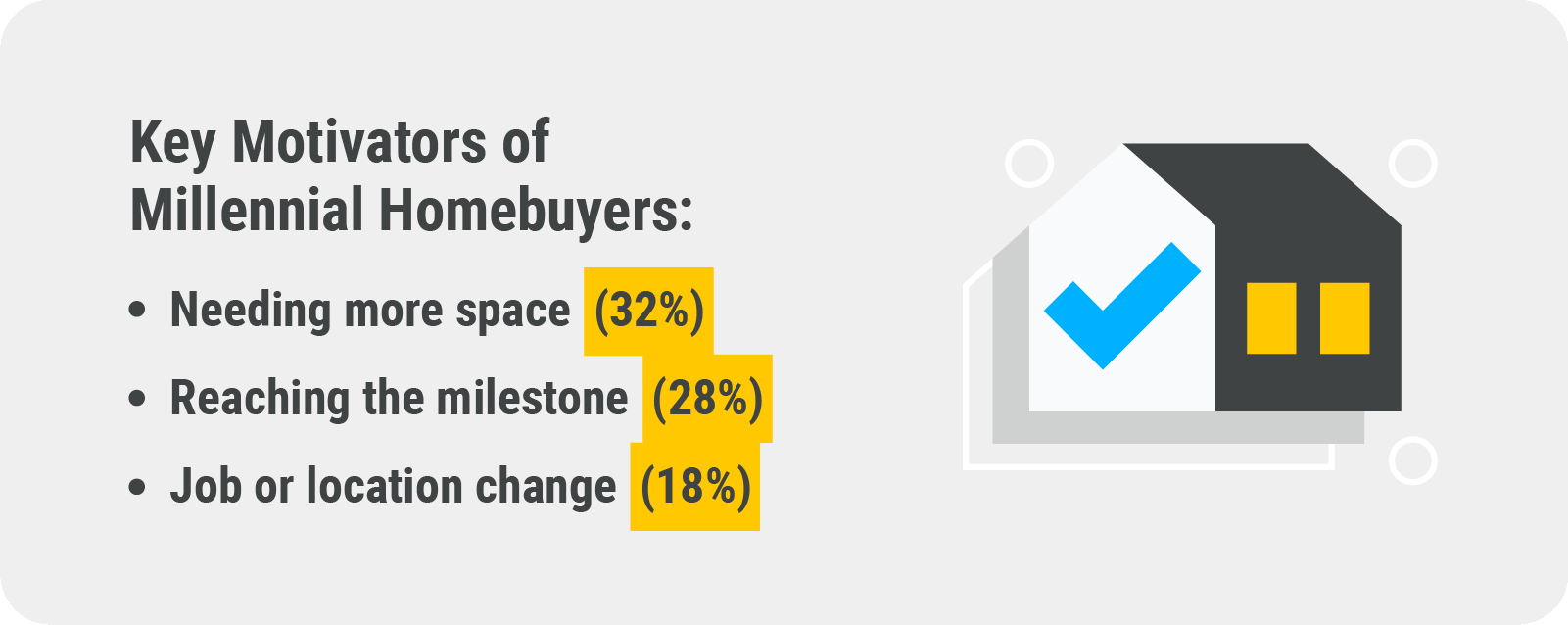

Millennials are individuals born between 1981 and 1998 and are currently ages 22 to 39. With the median age range of first-time homebuyers at 34 years old, this makes millennials the generation that’s now dominating the home buying market. Here’s a breakdown of the kinds of buyers who currently make up the millennial homebuyer market:

Millennials are eager to buy homes, but are they financially prepared for such a huge investment?

With many millennials facing financial challenges, their ability to save for a home has halted. Besides a down payment, the overall cost of living has been a burden facing most of this generation.

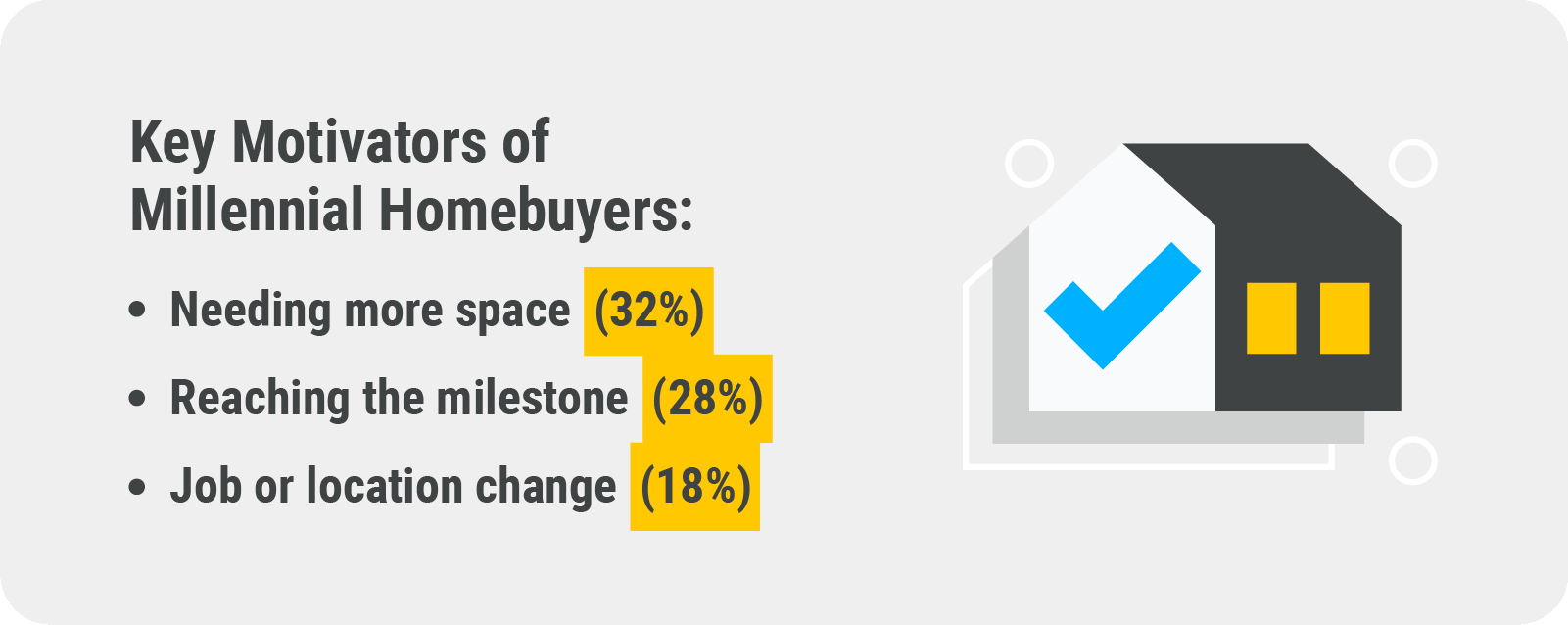

Regardless of their debts or costs of homes, becoming a homeowner still remains a top priority. So much so that millennials are willing to put off major life events — like having a wedding or a child — to be able to save for a home.

Many millennials rely on first-time homebuyer programs to ease the stress of affording a down payment. No matter the obstacles, this generation continues to prove that they’re willing to do what it takes to reach such a huge financial milestone.

Tip for Homebuyers:

Most states offer down payment assistance programs for first-time homebuyers that may be used in addition to FHA benefits, depending on your state’s guidelines. These programs can help cover down payment costs, closing costs and provide homebuyer education. Research local affordability programs to see if you qualify, or check our first-time homebuyer program state directory for more information.

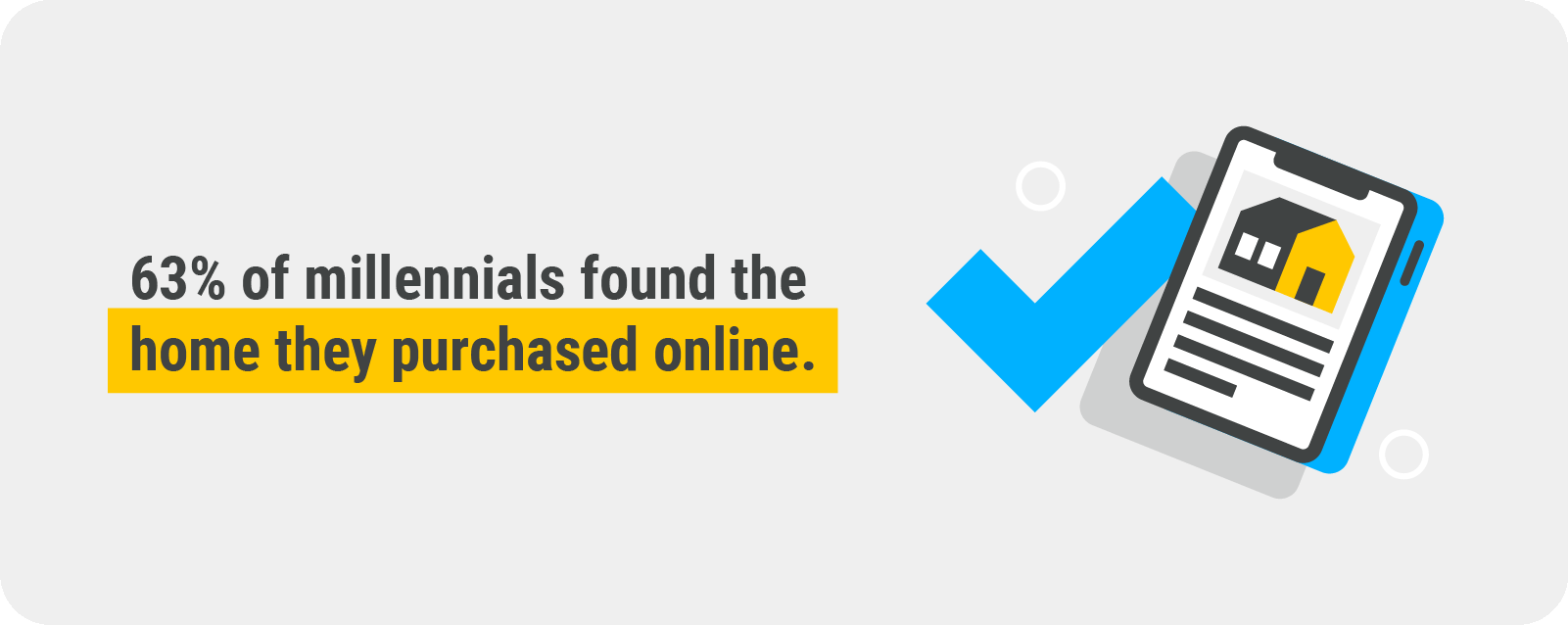

As a generation who grew up tech-savvy, millennials lean on the internet as their trusted source of information. Many millennials rely on online sources to help guide them through the home buying process’s beginning stages. In order for real estate agents, mortgage lenders and homesellers to lure this generation in, building a strong and aesthetically pleasing online presence is essential.

"Consult with your agent to discuss putting yourself in the best possible position to make an offer on a dwelling specific to the market in which you are purchasing — i.e. a pre-approval letter, a game plan with your agent, potential out of pocket expenses and proper reserves that will be needed to negotiate from a position of want as opposed to a position of need,” said Gregory P. Chaplain, Real Estate Agent at The Real Estate Group.

While many may think that millennials lean toward city life, recent data shows otherwise. More than half of this generation is interested in purchasing a home in a suburban area opposed to urban city areas. As millennials are nearing their 30s, starting a family and settling down have become top priorities for many. With this is mind, good neighborhoods and school districts have massive appeal to millennials.

To avoid the extra work associated with fixer uppers and older homes, this generation favors homes that are move-in ready, even if that means sizing down a bit. Those leaning towards older homes do so because they believe they have a better overall value. This generation has shown that they prefer buying a single-family home over purchasing a condo or apartment because it’s a better investment as a first-time buyer.

Energy efficient features seem to be a leading trend millennials look toward in home purchases, with efficient lighting and appliances being top features.

Tip for Homebuyers:

FHA’s energy-efficient mortgage program is available to buyers looking to go green on their home and save money on utility bills. This program helps buyers finance energy efficient improvements with their FHA insured home loan. Through this program, buyers will be eligible for a higher loan amount to cover the costs of added appliances and improvements. Though the loan amount will be higher initially, it makes it more affordable for homeowners by lowering operating costs.

“Common energy-efficiency red flags home shoppers should look for before putting an offer in on a home include anything related to utilities, old or neglected plumbing, electrical or HVAC in the home,” said Szana Marr, Real Estate Agent at Boardwalk Realty.

With the average age of first-time homebuyers being around 33 years old, you wouldn’t guess that Gen Z would be interested in buying a home anytime soon, but home buying is becoming a priority for the older individuals of this generation.

Gen Z was born between 1997 and 2012 and are currently ages 8 to 23. Though they only account for about one percent of new homebuyers, they are predicted to continue to make their way into homeownership in the next few years. Even with the difference in age, Gen Z and millennial values and outlook on homeownership are very similar.

Millennials are projected to continue to dominate the housing market as we enter 2021. With the effects of the pandemic dropping interest rates, millennials took full advantage of putting down smaller down payments, despite the rise in home prices. With more millennials working from home, sellers will begin to shift their strategies to showcase features of homes that are suitable to this new lifestyle. Though 2020 was an unpredictable year, experts predict a strong home buying season in the Spring and Summer of 2021.

Tip for Homebuyers:

As we enter 2021, mortgage rates are projected to remain low and stable, making it an ideal time to become a homeowner. Lower interest rates could increase your buying power, meaning you may be able to afford more homes than you initially expected with higher rates. Receiving a lower interest rate can save you money over time, making home buying more affordable to first-time home buyers.

Housing trends are constantly changing, and millennials prove that their priorities and the way they search for homes continue to evolve. With so many millennials ready to settle down and start their home buying journey, this generation will continue to rule the housing market for years to come.

If you’re a millennial looking to purchase your first home, let us help you qualify for an FHA loan and start your journey to homeownership.

References