When it comes to mortgages, you have a lot of options. Two of the most common are FHA and conventional loans.

Though both can be great products to help you buy a home, each has its own unique pros and cons and one may be better tailored to your income level, credit score and homebuying goals -- so know the difference and which option may be a better fit for you.

Let's take a closer look.

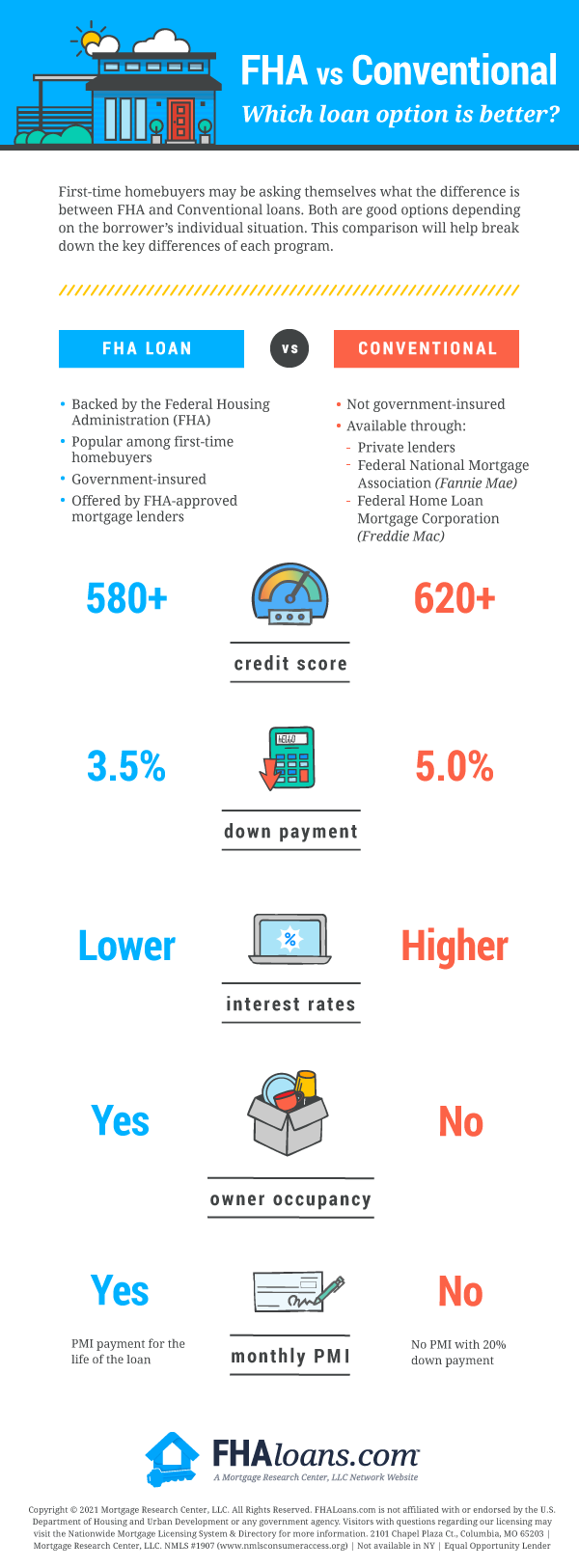

FHA loans and conventional loans have vastly different credit score thresholds. In addition, with the FHA loan, your credit score also affects the minimum down payment requirement.

With the FHA loan, homebuyers whose credit score is 580 or higher may qualify for the lower 3.5% down payment option, while those with a credit score between 500 and 579 may still qualify, but need at least 10% down.

Conventional credit requirements can vary by lender, but typically conventional loans require a credit score in the 620-640 range regardless of down payment. This higher threshold often excludes those with less-than-perfect credit and many first-time homebuyers.

As mentioned above, FHA loans allow as little as 3.5% down – or about $7,000 on a $200,000 home.

Down payment requirements for conventional loans can vary by lender and other factors but a 5% minimum is common. That would mean a $10,000 down payment on a $200,000 property.

If coming up with your down payment is difficult, both loan types allow you to use gift money toward your payment. However, with an FHA loan, your entire down payment can be from gift funds, while those using a conventional loan may need to put down a portion of their own funds before being able to include gift money. Talk with a lender for more details.

Questions about whether you qualify?

Find an FHA lender who can work with you every step of the way. →Conventional loans typically require private mortgage insurance unless borrowers can put down 20%. Costs for PMI can vary based on your credit score and other factors, but it can easily add $100 or more to your monthly payment. This expense typically ends once your loan-to-value ratio reaches 80%.

Conversely, FHA loans require mortgage insurance no matter what -- even if you’re putting 20% down. FHA loans come with both a one-time upfront fee and annual mortgage insurance premium (which you’ll pay monthly, as part of your mortgage payment).

The upfront MIP, sometimes referred to as the FHA funding fee, is 1.75% of the loan amount. This fee is due at closing and is typically financed into the entire loan amount to reduce out of pocket costs.

The annual MIP ranges from 0.15% to 0.75% depending on loan term, loan amount and down payment. However, for most FHA borrowers, the annual MIP is 0.55% of the loan amount.

The annual MIP can last for the life of the loan, or be removed after 11 years if the original down payment is 10% or more.

You can learn more about FHA mortgage insurance here.

Both FHA loans and conventional loans offer refinance options. On conventional loans, you’ll need to undergo a credit check, and the lender will send out an appraiser to assess the value of your home.

Though FHA loans can also be refinanced in a similar fashion, some borrowers may be able to qualify for the agency’s streamline refinance program, which requires no appraisal, no credit check and no income verification. Both options can help you lower your rate or shorten or extend your term.

FHA loans tend to be looser on debt-to-income ratios, though they don’t have as high loan limits as conventional mortgages do. The exact limits vary from county to county, but they generally come out to a max loan of $498,257. FHA loan limits are higher in more expensive parts of the country.

Find the FHA loan limit in your area here.

Conventional loans don’t have hard loan limits, but borrowers looking for larger (jumbo) loans will typically encounter tougher lending guidelines. Generally, loans above the conforming loan limit are considered “jumbo” loans, but that limit can vary depending on location.

For both loan types, caps on debt-to-income ratio will vary by lender and other factors.

What is the difference between a conventional loan and FHA loan? As you’ve seen, there are many places the two mortgage products diverge.

In short, if you have great credit and savings for a minimum 5% down payment, a conventional loan may be right for you; however, those with less-than-perfect credit and first-time homebuyers may find the FHA loan is a better fit.

To get the full picture on how costs can break down and differ between each loan, see the chart below, which considers a $200,000 home purchase with a 30-year term. We’ll assume the conventional loan requires a 5% down payment and comes with reasonable private mortgage insurance expenses. In our example, the FHA's upfront MIP is not shown in the table, but is financed in the entire loan amount and included in the calculation.

| LOAN TYPE | DOWN PAYMENT | PRINCIPAL AND INTEREST PAYMENT | MONTHLY MORTGAGE INSURANCE | MONTHLY PRINCIPAL & INTEREST PAYMENT |

|---|---|---|---|---|

| FHA | $7,000 | $1,054.19 | $92 (Annual MIP) | $1,189.98 (upfront MIP included in calculation) |

| CONVENTIONAL | $10,000 | $1,019.96 | $81 (PMI) | $1,100.96 |